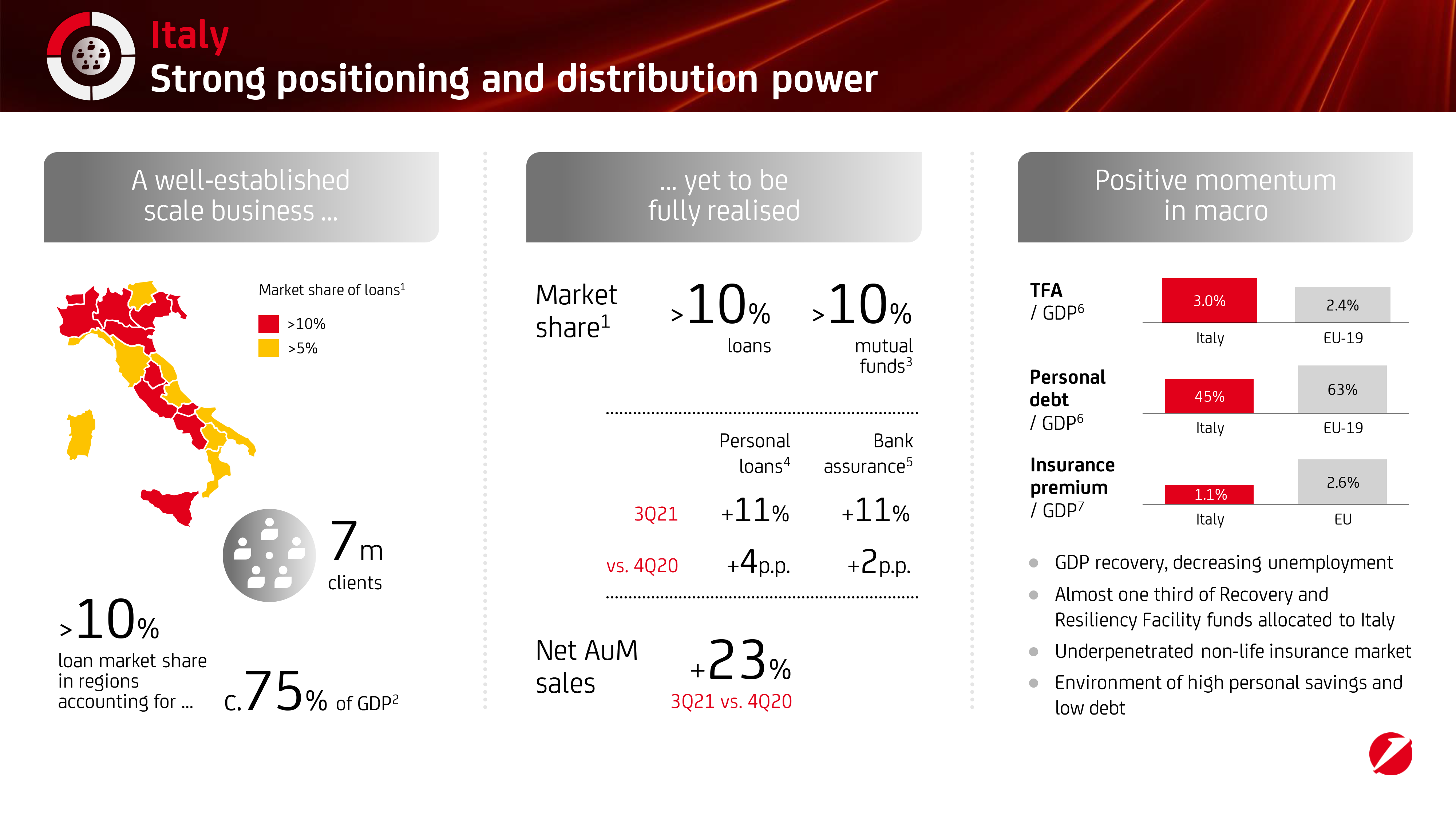

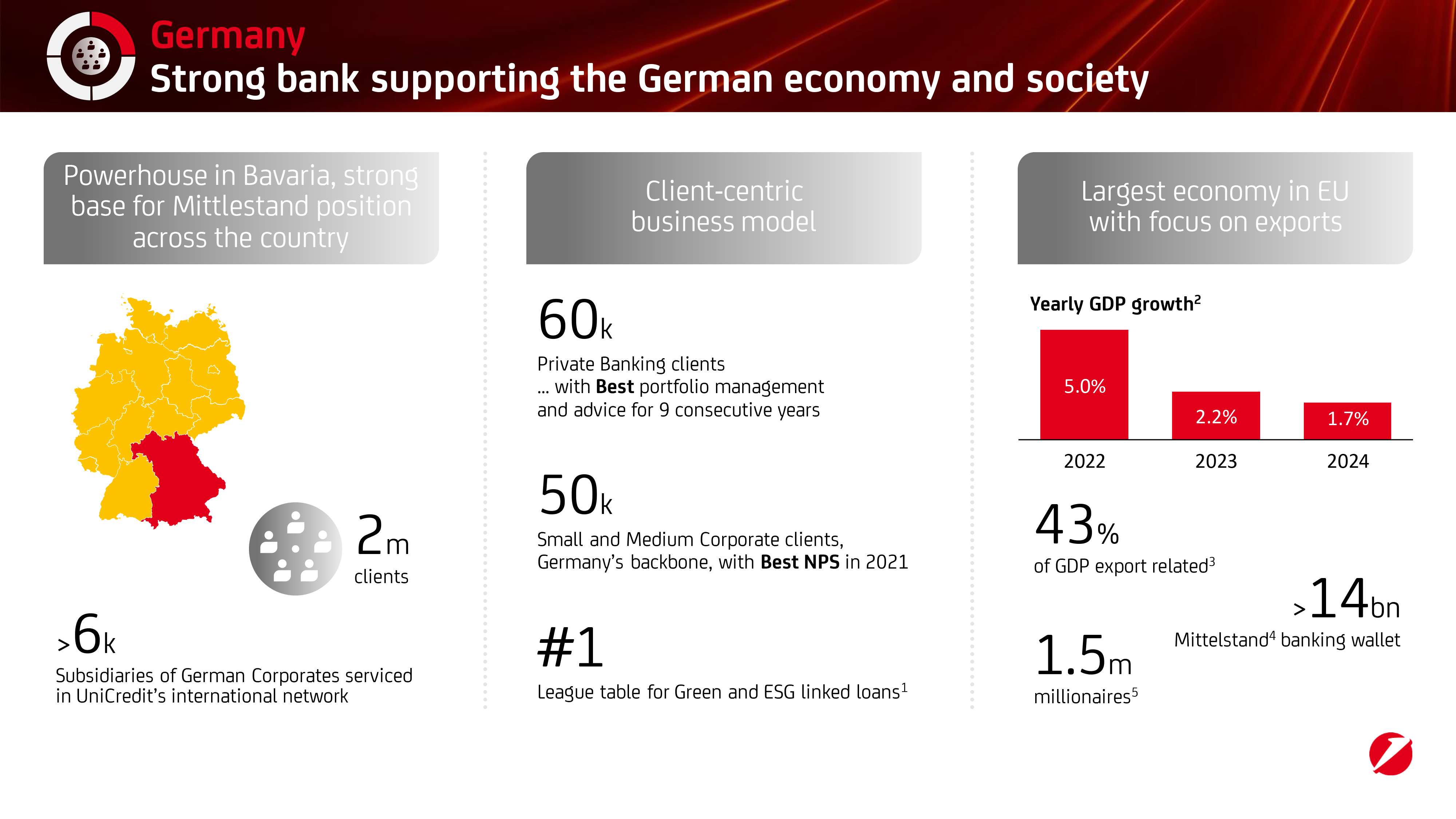

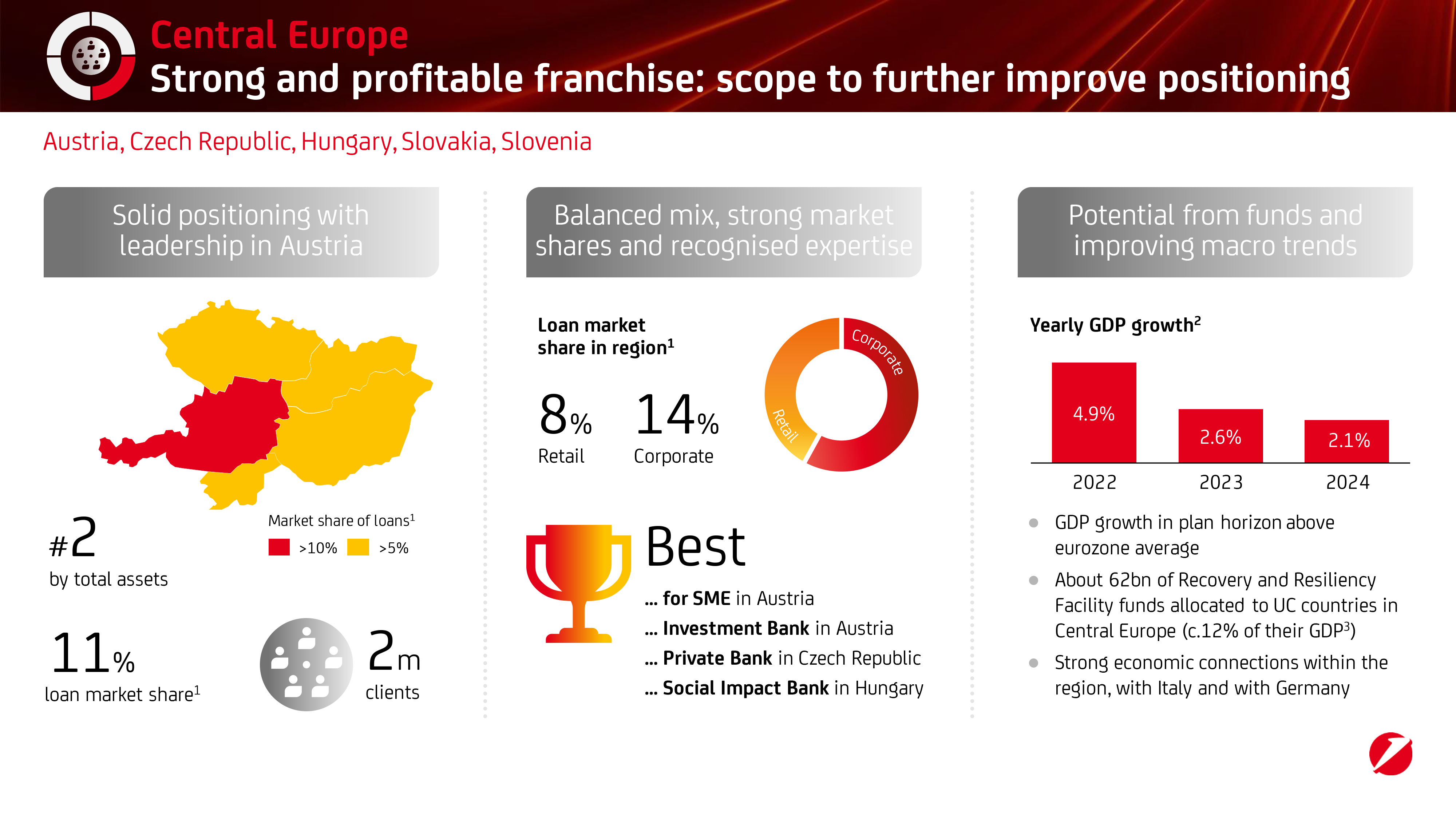

Each of our regions have differing strengths and challenges. Each are critical to our success. UniCredit Unlocked will encourage our banks to celebrate their own identities, while at the same time providing them with the strength and scale of the collective. Working together, we can provide better solutions for clients than we could alone, particularly in digital and data and client solutions.

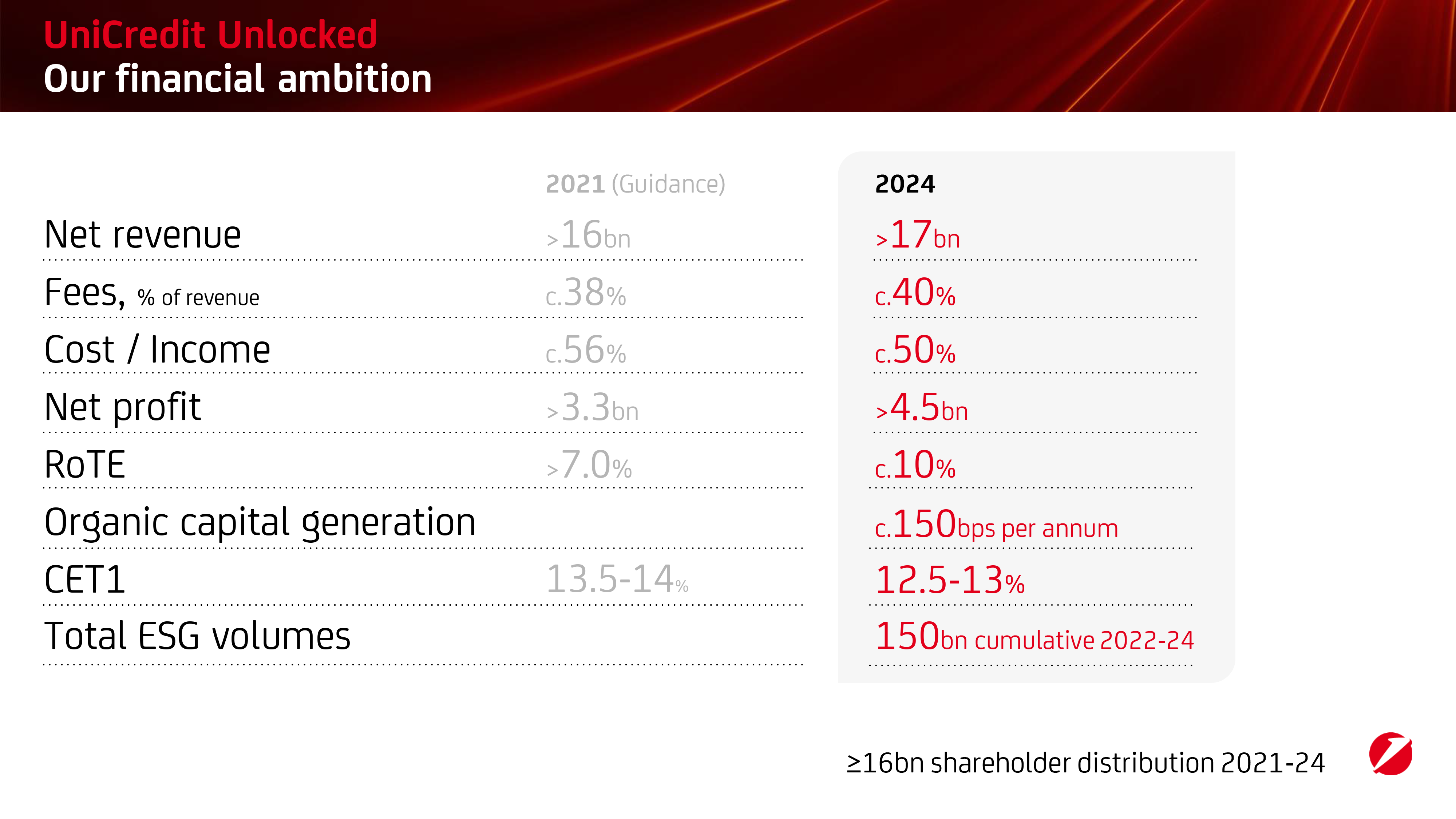

UniCredit Unlocked

Our financial ambition

Net revenue 2021 >16bn; 2024 >17bn

Fees, % of revenue 2021 c.38% ; 2024 c.40%

Cost / Income 2021 c.56%; 2024 c.50%

Net profit 2021 >3.3bn; 2024 >4.5bn

RoTE 2021 >7.0%

Organic capital generation; 2024 c.150bps per annum

CET1 2021 13.5-14%; 12.5-13%

Total ESG volumes ; 150bn cumulative 2022-24

≥16bn shareholder distribution 2021-24

In Italy, we will focus on higher growth and the most profitable areas. We will achieve a net profit of more than 2 billion euros, with an average annual growth rate of 4% and a 3 percentage point increase in ROAC, which will exceed 12% by the end of the plan.

In Germany, our ambition is to lead in profitability. The plan will deliver >€1 billion of net income, up 16% per annum. We will increase ROAC by 4%, to reach >10% by 2024.

In Central Europe, we will deliver more than >€1 billion of net income, up 13% per annum - constituting a quarter of the Group. This will increase ROAC by 3pts to 2024, to >13%.

In Eastern Europe, net revenues will increase 6% a year. Overall, the region will deliver around €1 billion of net income, a fifth of the Group in 2024 with a CAGR of 9%. The ROAC will rise by 4-p-p. to >16% by 2024 - the highest of all of our regions.