UniCredit has everything it needs to be the bank for Europe's future. This includes incredibly strong foundations across Europe, in our clients, in our people, and in our banks. UniCredit Unlocked is bringing these individual organisations together and releasing the potential within them to create something that is so much more than the sum of its parts.

UniCredit is a simplified, empowered organisation with a lean corporate centre that embeds digital and data across the business. We are organised across four regions: Italy, Germany, Central Europe, and Eastern Europe.

UniCredit is powered by three client agnostic product factories: Corporate Solutions, Individual Solutions, and Group Payments Solutions which deliver best-in-class products and services to all clients in all geographies and are a key enabler in our multi-year plan. Together, these make up half of our revenues.

Under this approach, top-tier solutions are constantly being developed in-house and through partnerships with leading providers.

Moreover, by segmenting our clients equally across the Group, we are able to take the scale of our product factories and tailor them to serve each different client segment in the most effective manner. Through this process of simplification and optimisation, UniCredit will become one fully united bank, delivering for all clients in a unified way.

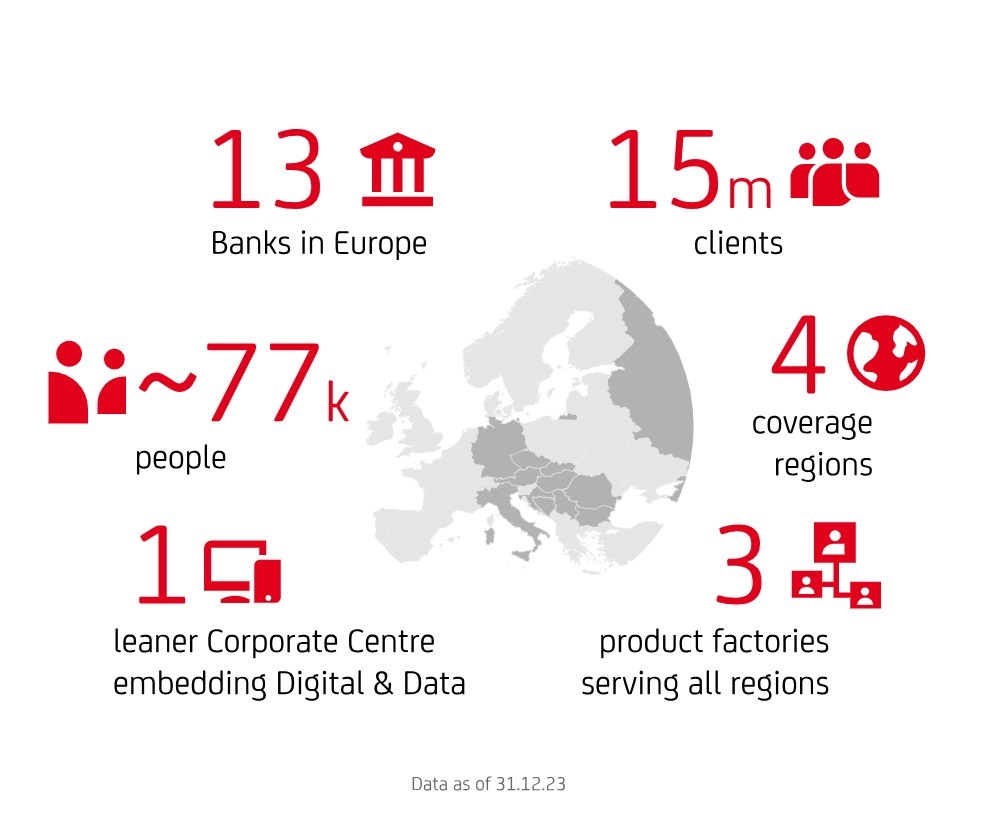

The infographic above (data as of 31.12.23) describes our service model:

- 15 million clients

- 77 thousand people

- 13 banks in Europe

- 4 coverage regions

- 1 leaner Corporate Center embedding Digital & Data

- 3 product factories serving all regions

A pan-European Commercial Bank connecting with clients in a unified way across Europe.

UniCredit is a pan-European bank leader in 13 countries and a standalone presence in Italy.

UniCredit is one of Europe's leading financial groups and the leading bank in Italy, with an independent management, a widespread network of more than 2,000 branches and 7 million customers. We operate with Seven Territorial Areas across the Country (North West, Lombardy, North East, Central North, Central, South and Sicily) delegated to manage engagements with the territories, capturing local communities' needs and specificities, as well as three product factories: Corporate Solutions, Individual Solutions and Group Payments Solutions.

UniCredit is a pan-European bank leader in 13 countries. In Germany UniCredit is present with HypoVereinsbank one of the leading banks in the German market.

UniCredit is one of Europe's leading financial groups and its local subsidiary HypoVereinsbank (UniCredit Bank GmbH) is the third largest private bank in Germany. As a universal bank, deeply rooted in the German market with a history of more than 150 years, HypoVereinsbank offers a comprehensive range of banking and financial products and services to retail, corporate and public sector customers, international companies and institutional clients. Supported by three product factories, Corporate Solutions, Individual Solutions and Group Payments Solutions, HypoVereinsbank's products and services are available through its branch network as well as innovative remote, digital and mobile channels meeting the individual needs of its broad client base.

Through Central Europe we operate in 5 countries: Austria, Czech Republic, Hungary, Slovakia and Slovenia.

In Central Europe, with more than 2 million clients and a market share of around 11%, we are the leading bank in Austria by assets and, overall, number two by number of clients and assets.

In Central and Eastern Europe we are the undisputable Bank of Choice for International customers: serving 2 out of 3 top 100 international customers.

Through Eastern Europe we operate in 5 countries: Bosnia and Herzegovina, Bulgaria, Croatia, Romania, Russia and Serbia.

In Eastern Europe, with around 4 million clients, we are the number one bank in assets with a market share that is well above 15% in many countries. In particular, we are number one in Bosnia and Herzegovina, and Croatia, number two in Romania (including Alpha Bank Romania) and in top three in Bulgaria and Serbia.

In Central and Eastern Europe we are the undisputable Bank of Choice for International customers: serving 2 out of 3 top 100 international customers.