The 2022's edition of the Italian Investment Conference, one of the largest platform in Italy to access the equity and debt capital markets, ended last week. Along three days, c. 90 issuers - representing a combined market cap of almost half a trillion euro for the equity piece - and over 450 institutional investors (of which approx. 90% coming from outside Italy) generated over 1.500 One-on-One and group meetings. The conference's agenda was complemented by an high profile keynote session, where senior policymakers and industry champions in the energy field discussed the current outlook, the strategies to secure energy supply in the short run, and to manage the green transition in the longer term.

"Since long time the Italian Investment Conference has been a jour-fixe among institutional investors and the most representative Italian companies and financial institutions. This gathering was even more compelling this year, following an uncertain economic scenario, a sustained market volatility, and a biting inflation. As UniCredit, we feel it is part of our responsibility to promote this kind of meetings to facilitate reading of facts, while improving the access to capital markets", said Richard Burton, Head of Client Solutions at UniCredit.

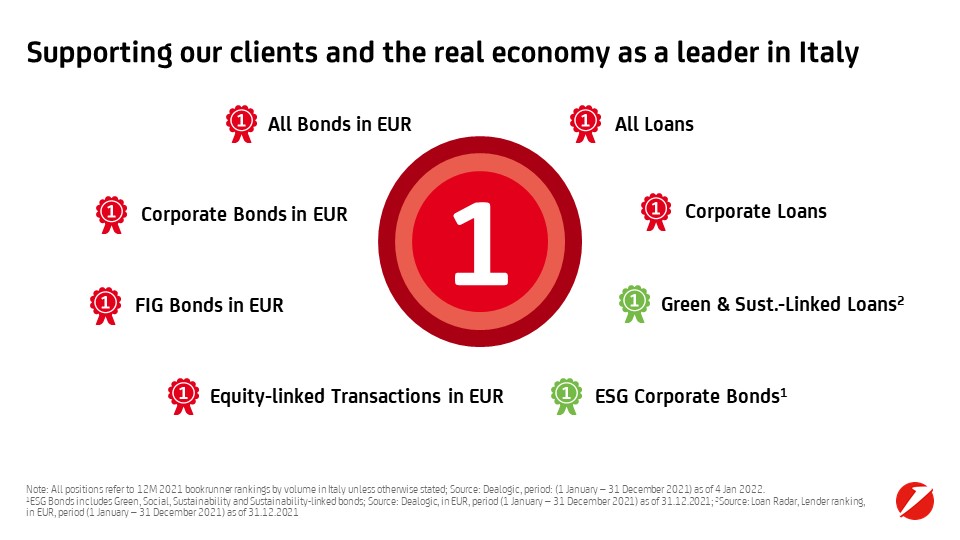

The strong positive response and continuously increasing participation confirms the relevance of the Italian Investment Conference as a "must-attend" event to exchange ideas and views among Capital Markets specialists - highlighting at the same time UniCredit's important role as the partner of choice for Equity, Debt, and Loan Capital Markets transactions - as highlighted in the credentials here below.