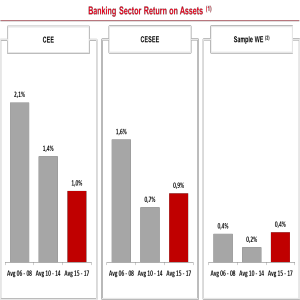

Looking forward, UniCredit researchers expect the economic recovery to support lending, especially in countries which so far have been lagging behind. Moreover positive GDP growth in combination with accommodative monetary policies and clean-up activities in countries such as Romania, Slovenia and Hungary should ease the strain from NPLs. Profitability is expected to remain above Western European levels.

CEE region remains the growth engine for UniCredit

In spite of some challenges, UniCredit considers itself a long-term, strategic investor in Central and Eastern Europe, which is keen to develop its business with both corporate and private customers in the region. In 2015 the banking group has acquired over 1.2 million new customers across all CEE countries, where it has a presence, and it intends to grow its customer base by another 1 million customers each year until 2018. According to its Strategic Plan UniCredit is going to invest EUR 1.2 billion into digitalization aiming equally at matching new trends in customer behaviour and reducing cost. The number of internet banking users is projected to increase from currently 5 million to 10 million and the number of mobile banking users from currently 1 million to 7 million over the next three years. CEE lending volume is expected to grow by EUR 20 billion to EUR 106 billion in 2018.

UniCredit is still the banking group number one in Central and Eastern Europe - in terms of network, total assets and geographic diversification. The banking group operates an extensive network of almost 3,100 branches in 13 countries, which generates roughly one quarter of its total revenues. UniCredit in CEE serves more than 25,000 international corporate customers through its International Centers. 2 out of 3 international corporate customers from Germany, Italy and Austria operating in CEE are UniCredit customers. The banking group has a long-established expertise in handling state and EU-supported programs in the CEE region resulting in more than EUR 2 billion facilities dedicated to EU Funds projects approved and another over EUR 1.3 billion agreements signed. UniCredit banks are among the top-banks in their respective home country.

"Its broad diversification by customers, products and geographies has made CEE region a consistently strong contributor to the Group´s financial results. With the intended transfer of CEE shareholdings directly under UniCredit SpA by year-end 2016 we make another move towards a leaner governance structure as well as a more effective capital and liquidity management", said Carlo Vivaldi, Head of CEE Division at UniCredit, "We are fully committed to the new Strategic Plan and go ahead with investing into digitalization and Big Data in order to expand our regional customer business."