OUR CONCRETE ANSWERS TO SOCIAL NEEDS

Monday 15 March 2021

UniCredit Social Impact Banking continues to support businesses and vulnerable groups across its markets

Social Impact Banking ("SIB") is UniCredit's commitment to building a fairer and more inclusive society by identifying, financing and promoting initiatives that can have a positive social impact.

We look back at a selection of our SIB initiatives across some of the countries we operate in over the past months and to how we are constantly focused and committed to being part of the solution in these difficult and challenging times, supporting individuals and communities in need.

Partnerships for the Goals

In line with the UN Sustainable Development Goal number 17 "Partnerships for the goals", Social Impact Banking (SIB) works with different partners that share the same vision of building a culture of sustainability and increasing social impact in our communities.

The Danube Transnational Programme

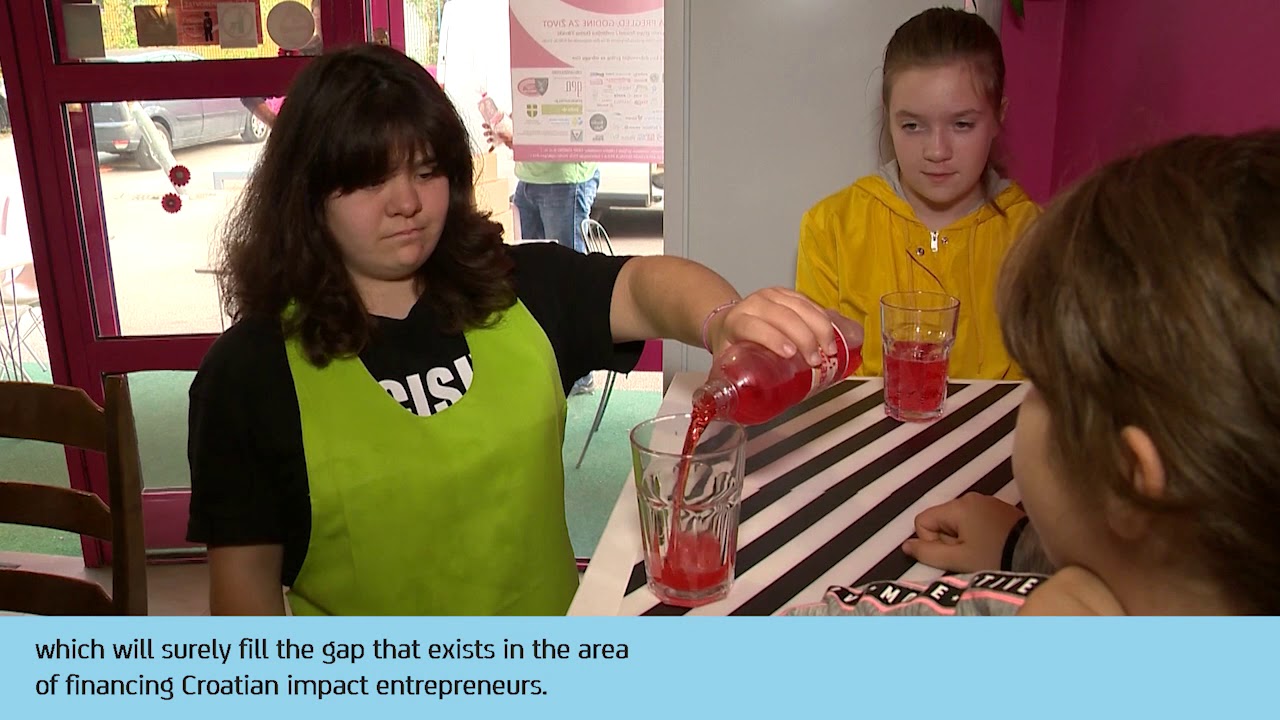

UniCredit is the Main Partner of the Finance 4 Social Change project, part of the EU Danube Transnational Programme. The bank joined this project through SIB.

Below you can hear from our colleagues in Croatia and Hungary who, together with local partners, have been supporting the many entrepreneurs involved in the programme:

CNA Impresa Donna

UniCredit and CNA Impresa Donna have promoted a series of free webinars in Italy to encourage the growth of female entrepreneurship as part of SIB’s commitment to offer concrete support to women and their families. The initiative has so far registered 634 interested female entrepreneurs with 280 participants connecting to the first webinar.

HypoVereinsbank for Social Impact in Germany

In January 2020, HypoVereinsbank joined the Bundesinitiative for Impact Investing through its local SIB programme with the aim to further advance social impact investments in the German market and generate positive and measurable change in the community by addressing today's complex social challenges.

Supporting vulnerable groups – focus on Italy

In the last months, UniCredit Social Impact Banking has continued to support communities across Italy with a particular focus on initiatives for disadvantaged people:

Coop La Via in Agordo received a 1 million euro social impact loan to help the organisation adapt its production sites and continue to support disadvantaged people and those facing social hardship in entering the labour market. In addition, Coop La Via will be able to benefit from a donation of 30,000 euros upon the achievement of specific social objectives through SIB’s “pay for success” mechanism.

Società Dolce of Bologna received a 3.6 million euro social impact loan with the Sace guarantee to increase the quality of service offered to disabled people in the Cremona area through the restructuring of three care centres. Also in this case, the SIB “pay for success” model will seek to award the company with a donation of 20,000 euros once its social objectives, regarding the greater autonomy and social inclusion of guests alongside maintaining a high level of service, are achieved. The cooperative plans to use this donation for the creation of a therapeutic garden aimed at supporting the motor, sensory and imaginative abilities of its guests. The garden would also be open to the wider community for educational and recreational purposes.

Istituto di Diagnosi e Cura Hermitage Capodimonte in Naples was supported with a 2.5 million euro social impact loan with the MCC 90% guarantee as part of the Italian government's Liquidity Decree aimed at supporting investments related to infrastructure upgrades in line with the local COVID-19 regulation. The institute is further able to benefit from a disbursement that will create a fund for four scholarships from the Parthenope University in collaboration with UniCredit Foundation, and for six-month internships offered to economically disadvantaged talented students.

Società Cooperativa Sociale Libellula of Lecce also received a social impact loan with the MCC 90% guarantee under the Italian government's Liquidity Decree for opening two new centres in the province of Lecce aimed at supporting minors suffering from psychological distress. This includes the creation of a therapeutic semi-residential centre for minors located in Nardò. The cooperative will further receive a 5,000 euro donation for the purchase of an interactive whiteboard (LIM).

The social cooperative Pulcherrima Res, focused on the management and enhancement of Sicilian monuments, received a 150,000 euro social impact loan for the improvement of the Monastery of Santa Caterina in Palermo. The cooperative intends to enhance the production and marketing of sweets in the Monastery, using the funding also to activate regional and national distribution channels and an e-commerce platform. In addition, the funds will be used to purchase necessary laboratory and sanitary equipment.