Not for publication or distribution, directly or indirectly, in the United States, Italy, Canada, Australia or Japan.

UNICREDIT S.P.A ANNOUNCES INVITATION FOR OFFERS TO SELL VARIOUS GROUP ASSET BACKED SECURITIES FOR CASH

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, TO ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES OR THE REPUBLIC OF ITALY OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION

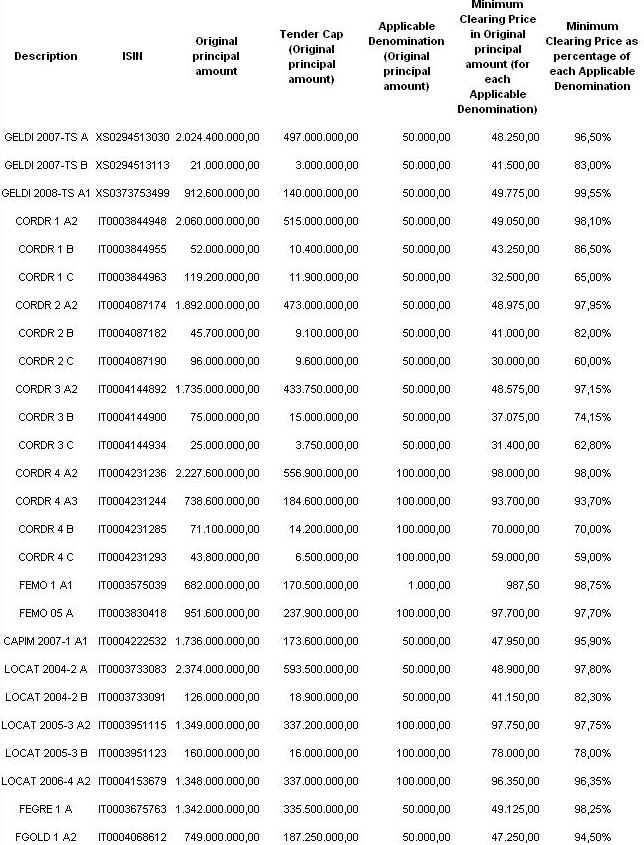

UniCredit S.p.A. ("UniCredit") announces an invitation to eligible holders of the securities described below (the "Securities") to submit offers to sell their securities through a modified Dutch Auction up to the Tender Cap and subject to the Minimum Clearing Price specified below in respect of each Security (the "Invitation")

The Invitation is scheduled to expire at 5.30 PM (Central European time) on 5 February 2010. Results will be announced on 9 February 2010 or as soon as practicable thereafter. Settlement is expected on 12 February 2010.

UniCredit will also pay accrued and unpaid interest on the Securities accepted for purchase, from (and including) the last payment date for such Securities falling on or before the Settlement Date to (but excluding) the Settlement Date.

UniCredit Group is intending to optimize its balance sheet and to support its main outstanding securitisation programmes, which include Italian RMBS, Italian Leasing and German SMEs by offering investors the possibility to tender such Securities in exchange for cash.

Full terms and conditions of the Invitation are set out in the invitation for offers memorandum dated 25 January 2010 (the "Invitation Memorandum"). The Invitation Memorandum and any other offer materials may not be distributed to investors located or resident in the US or Italy, or to investors located in a jurisdiction where the distribution of such documents is unlawful under applicable laws. Other restrictions apply (including in the UK and France). Terms not defined herein will have the meaning ascribed to them in the Invitation Memorandum

For further information:

Subject to compliance with the applicable restrictions set out below, requests for information in relation to the Invitation (other than in respect of the procedures for submitting offers of Securities) may be directed to:

The Dealer Manager:

UniCredit Bank AG

Attention: Ralf Brech Paolo Montresor

Tel: +49 89 378 15890 Tel: +44 (0)20 7826-6502

E-mail: ralf.brech@unicreditgroup.de E-mail: paolo.montresor@unicreditgroup.eu

Subject to compliance with the applicable restrictions set out below, requests for a copy of the Invitation Memorandum and information in relation to the procedures for tendering Securities may be directed to:

The Tender Agent:

Bondholder Communications Group LLC

Attention: Anne Bolton

Telephone: +44 20 7382 4580

Fax: +44 20 7067 9239

Email: abolton@bondcom.com

Subject to compliance with the applicable restrictions set out below, information on the Invitation can also be found on the Tender Agent's website: www.bondcom.com/unicreditABS

Milan, January 25, 2010

UniCredit S.p.A

Enquiries:

Media Relations: Tel. +39 02 88628236; e-mail: MediaRelations@unicreditgroup.eu

Investor Relations: Tel. + 39 02 88628715; e-mail: InvestorRelations@unicreditgroup.eu

DISCLAIMERS

This announcement must be read in conjunction with the Invitation Memorandum. No invitation to sell Securities is being made pursuant to this announcement. The Invitation is only being made pursuant to the Invitation Memorandum and any offers should be made solely on the basis of information contained in the Invitation Memorandum. None of UniCredit S.p.A., the Dealer Manager, the relevant issuers of the Securities or the Tender Agent makes any representation or recommendation whatsoever regarding the Invitation and/or as to whether holders of Securities should submit offers or refrain from doing so pursuant to the Invitation, and no one has been authorised by any of them to make any such representation or recommendation. Any holder of Securities should make its own assessment of the merits and risks of offering its Securities pursuant to the Invitation Memorandum and should seek its own advice (including in respect of any tax consequences) from its stockbroker, bank manager, solicitor, accountant or other independent financial or legal adviser.

INVITATION AND DISTRIBUTION RESTRICTIONS

The distribution of this announcement, the Invitation Memorandum and any other document or material relating to the Invitation may be restricted by law in certain jurisdictions (including in the United States, Italy, Canada, Australia or Japan). Persons into whose possession this announcement, the Invitation Memorandum and/or any other document or material relating to the Invitation come are required to inform themselves about and to observe any such restrictions. Neither this announcement nor the Invitation Memorandum or any other document or material relating to the Invitation constitutes an offer to buy or a solicitation of an offer to sell Securities in any jurisdiction in which, or to or from any persons to or from whom, it is unlawful to make such offer or solicitation under applicable law.

United States - The Invitation is not being made, and will not be made, directly or indirectly, in or into, or by use of the mails of, or by any means or instrumentality (including, without limitation, facsimile transmission, telex, telephone, e-mail and other forms of electronic transmission) of interstate or foreign commerce of, or any facility of a national securities exchange of, the United States, and no offer of Securities may be made by any such use, means, instrumentality or facility from or within the United States, or by persons located or resident in the United States. Accordingly, this announcement, the Invitation Memorandum and any other document or material relating to the Invitation are not being, and must not be, directly or indirectly, mailed or otherwise transmitted, distributed or forwarded (including, without limitation, by custodians, nominees or trustees) in or into the United States, or to persons located or resident in the United States. Any purported offer of Securities resulting directly or indirectly from a violation of these restrictions will be invalid, and any purported offers of Securities made by a person located in the United States or any agent, fiduciary or other intermediary acting on a non-discretionary basis for a principal giving instructions from within the United States will be invalid. For the purposes of this paragraph, "United States" means the United States of America, its territories and possessions, any state of the United States of America and the District of Columbia.

Italy - The Invitation is not being made in the Republic of Italy ("Italy"). This announcement, the Invitation and the Invitation Memorandum have not been submitted to the clearance procedures of the Commissione Nazionale per le Società e la Borsa and/or the Bank of Italy pursuant to Italian laws and regulations. Accordingly holders of Securities are notified that, to the extent holders of Securities are persons resident and/or located in Italy, no Invitation is available to them and neither this announcement nor the Invitation Memorandum or any other document or material relating to the Invitation or the Securities may be distributed or made available in Italy.

United Kingdom - This announcement, the Invitation Memorandum and any other document or material relating to the Invitation are not being made, and such documents and/or materials have not been approved, by an authorized person for the purposes of section 21 of the Financial Services and Markets Act 2000. Accordingly, this announcement, the Invitation Memorandum and any such documents and/or materials, are not being distributed to, and must not be passed on to, the general public in the United Kingdom, and are only for circulation to persons outside the United Kingdom or to persons within the United Kingdom falling within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order")) or to other persons to whom it may lawfully be communicated in accordance with the Order.

France - The Invitation is not being made, directly or indirectly, to the public in France. Neither this announcement nor the Invitation Memorandum or any other document or material relating to the Invitation has been distributed or caused to be distributed and will be or caused to be distributed to the public in France and only (i) providers of investment services relating to portfolio management for the account of third parties and/or (ii) qualified investors (investisseurs qualifiés) other than individuals, all as defined in, and in accordance with, Articles L.411-1, L.411-2 and D.411-1 to D.411-3 of the French Code Monétaire et Financier, are eligible to participate in the Invitiation. Neither this announcement nor the Invitation Memorandum and any other offering material or information relating to the Invitation have been and will be submitted for clearance to or approved by the Autorité des Marchés Financiers.

Ireland - The Invitations are not being made, directly or indirectly, to the public in Ireland and no offers or sales of any notes or securities under or in connection with such Invitations may be effected except in conformity with the provisions of Irish law including the Irish Companies Acts 1963 to 2009, the Prospectus (Directive 2003/71/EC) Regulations 2005 of Ireland, the European Communities (Markets in Financial Instruments) Regulations 2007 of Ireland and the Market Abuse (Directive 2003/6/EU) Regulations 2005 of Ireland.