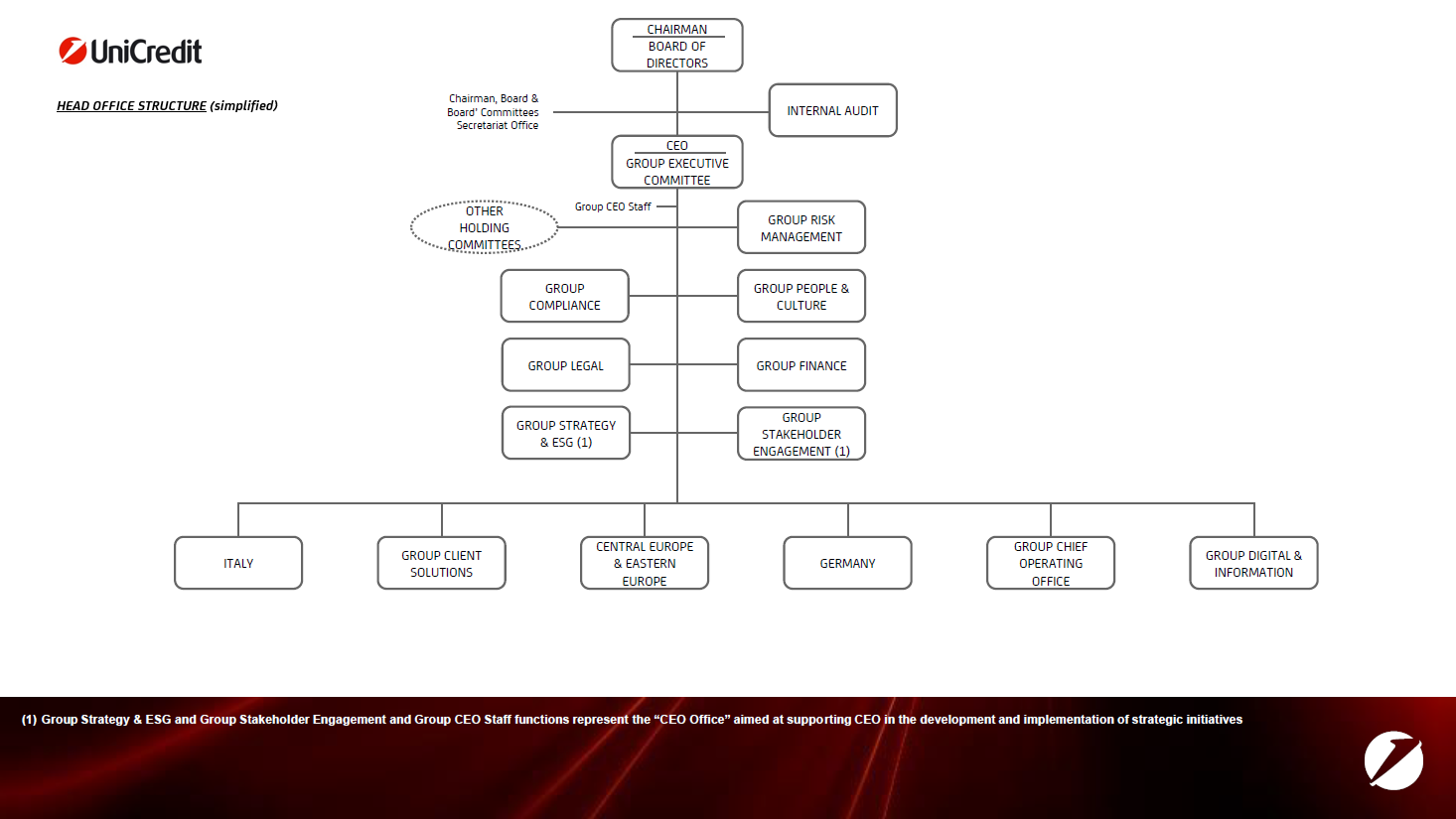

UniCredit adopts an organisational and business model that, while guaranteeing the autonomy of countries/local banks on specific activities in order to ensure greater proximity to customers and efficient decision-making processes, maintains a divisional structure for the governance of business/products, as well as global control over Digital and Operations functions.

More specifically, the current organisational structure of the Holding Company breaks down into:

- Group Finance, Group Risk Management, Group Legal, Group Compliance and Group People and Culture: functions identified as "Competence Lines" together with Internal Audit, aimed at steering, coordinating and controlling, for their area of competence, the management of activities and related risks of the Group as a whole and of the single Legal Entities;

- The Business Divisions "Italy" and "Central Europe & Eastern Europe"(1), focused on specific geographical areas, and "Group Client Solutions", with the responsibility for the marketing, service model definition and product development activities referred to the related customer segments/ geographies. Group Client Solutions in particular supports the business functions of the Countries developing a complete range of best-in-class products for all types of customers. To the Divisions report, where defined, the Business Lines, responsible for the related clients coverage in the segments/geographical areas of competence, as well as the Product Lines, responsible for developing products and services centrally. The Italy Network reports to the Italy Division. Germany represents the synthesis point of the Group business in the reference Country, maintaining an executive role at local level;

- Group Digital & Information Division defines and executes the Group Technology, Digital and Data related management and transformation, driving value through the capability of technology and data, embedded into digital solutions that optimize execution and improve customer experience, also through the governance of the relevant Service Lines;

- Group Chief Operating Office (Group COO), responsible for supporting the sustainable growth of the Group business and for generating value added for the benefit of the Countries/Group Legal Entities, through the oversight of the operating machine, in coherence with the defined Group strategies, ensuring synergies, savings and operational excellence, also through the governance of relevant Service Lines (e.g. Group Products COO, Group Procurement and Third Parties Management, Group Real Estate);

- Group Stakeholder Engagement governs the Group reputation and oversees all communication activities to ensure the delivery of coordinated and consistent messages across multiple Group stakeholders (investor relations, identity and communication activities, relationships with institutional counterparties and with the European Banking Supervisory Authorities - e.g. EBA, ECB - and Bank of Italy);

- Group Strategy & ESG, responsible for supporting strategic initiatives, including the integration of ESG into the Group strategy, also through the relevant Service Line (Group ESG).

The Group Strategy & ESG, Group Stakeholder Engagement and Group CEO Staff functions represent the "CEO Office", supporting the CEO in the development and implementation of strategic initiatives.

1) CE&EE, also named "Central & Eastern Europe" (CEE)