After the summer lull - UniCredit Wealth Management Outlook

Wednesday 29 September 2021

Let’s have a look at the macroeconomic topics that have influenced financial markets since the late summer. Here is the analysis of UniCredit Wealth Management’s investment specialists.

The Delta wave, supply bottlenecks, China’s growth pause and the tapering outlook – these are the topics that have repeatedly spoiled the mood of investors, companies and consumers. But even hard economic data such as production and retail sales numbers have disappointed of late. Therefore, it is quite possible that economic growth over the summer months will fall short of high expectations.

However, the global catch-up process will not stall or even break down. In fact, the global economy is not only expected to grow more strongly this quarter than in the spring, but at almost 6%, it is also likely to grow almost twice as fast as its potential.

Delta on the way, but no new lockdowns

The highly infectious Delta variant caused a sharp rise in the number of Covid infections this summer. This applies primarily to countries with low vaccination rates, especially in Asia. Continental Europe, on the other hand, is holding up much better in terms of infection rates. And on top of that, there are initial indications that the Delta wave is also approaching its peak elsewhere in the world and should then subside step by step.

In addition, thanks to the progress made in vaccination and improved treatment methods, health systems are significantly less fragile than at the beginning of the pandemic.

This makes renewed lockdowns in the service sector, which were so common in the second and third waves, unnecessary - not to mention the comprehensive company shutdowns at the beginning of the pandemic.

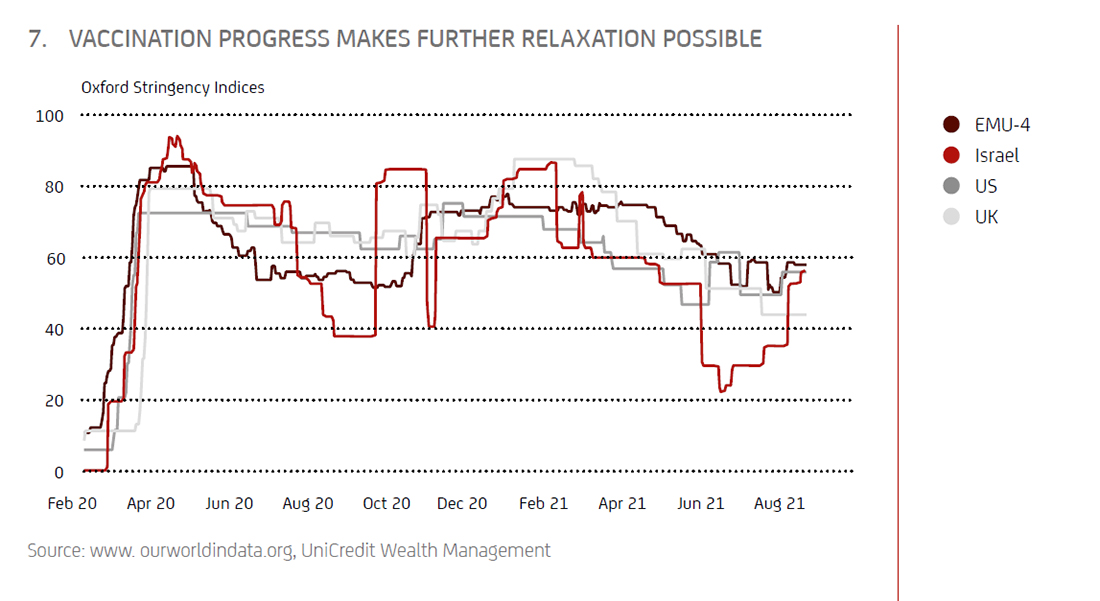

What's more, thanks to the progress made in vaccinations, the restrictions were even eased compared to the spring. The renowned Oxford stringency indices have been trending downwards - even if the decline has (temporarily) stalled more recently.

With further opening steps on the horizon, the all-important mobility indices will most probably continue to trend upwards. In the retail and recreation sub-segment, the pre-Corona levels have even been reached again across the EMU. However, there is still some upside potential in public transport and workplace visitors.

This is good news for our economies, as stringency and mobility indices have strongly correlated with GDP growth in past quarters. The comprehensive opening of the service sector (in combination with catch-up effects in consumption and investment as well as economic policy stimuli) was the key assumption for our expectation of a growth spurt in the second half of this year.

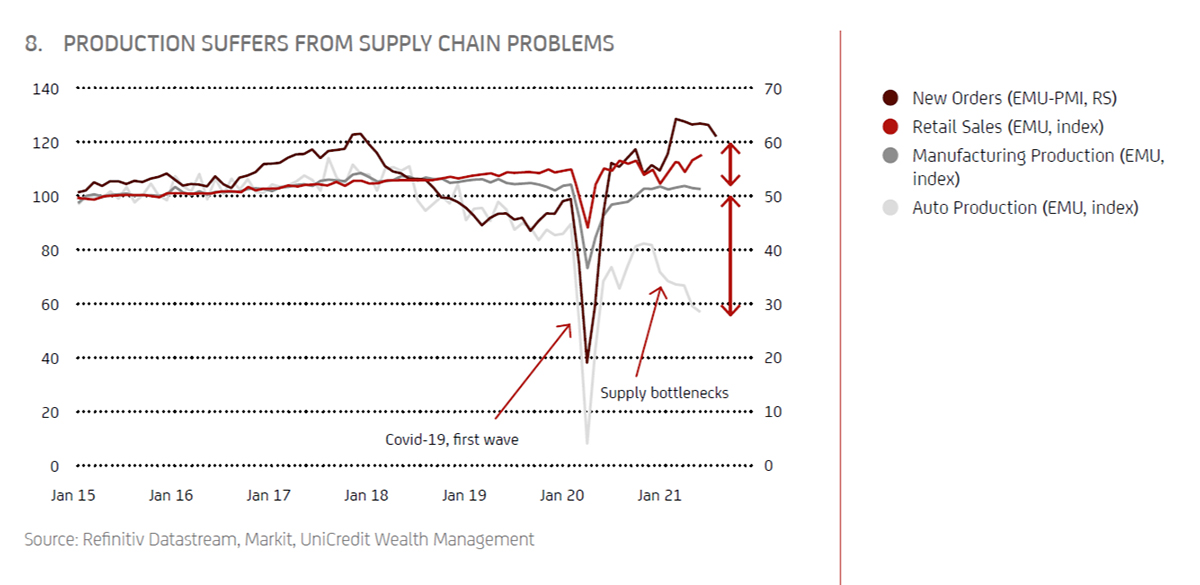

Supply bottlenecks are likely to be temporary

Therefore, it is no longer the pandemic that is severely affecting (global) supply chains and slowing down manufacturing and services production. Instead, an increasing number of companies are complaining about non-Covid-induced supply bottlenecks, delivery delays and shortages of materials and components. This not only limits their production possibilities, but also contributes significantly to the strong rise in inflation.

According to the Ifo Institute, two thirds of German industrial companies are currently complaining about a shortage of chips and electronic components, plastic granulates, steel and industrial metals respectively, but also construction materials. In addition, transportation capacities (ships and planes) are lacking as well. It is, therefore, hardly surprising that not only carmakers, but also the electrical industry, mechanical engineering, the plastics industry, construction and trade are currently facing supply chain problems.

Global supply chain problems will likely be with us for some time. But signs are pointing to an improvement beyond the short term. It should, therefore, take another 3 to 6 months until these deviations are largely corrected by short-term adjustments in industrial production. The purchasing managers' indices also provide a first indication of this. Suppliers' delivery times have declined recently, as has the ratio of new orders to inventories.

In addition, companies are increasingly diversifying their supply chains. More warehousing, more suppliers, more supplier countries and relocations back are the catchwords. This should bring relief further down the road - especially since the one-time burdens such as the blockade of the Suez Canal, the extreme weather events in the US or the fire-related downtime in chip production in Japan are a thing of the past. All this suggests that, in addition to production of services (additional opening), industrial output should also pick up significantly in the second half of this year. The soft patch of the past few months should therefore gradually come to an end.

Read more - UniCredit Wealth Management Monthly Outlook - September 2021