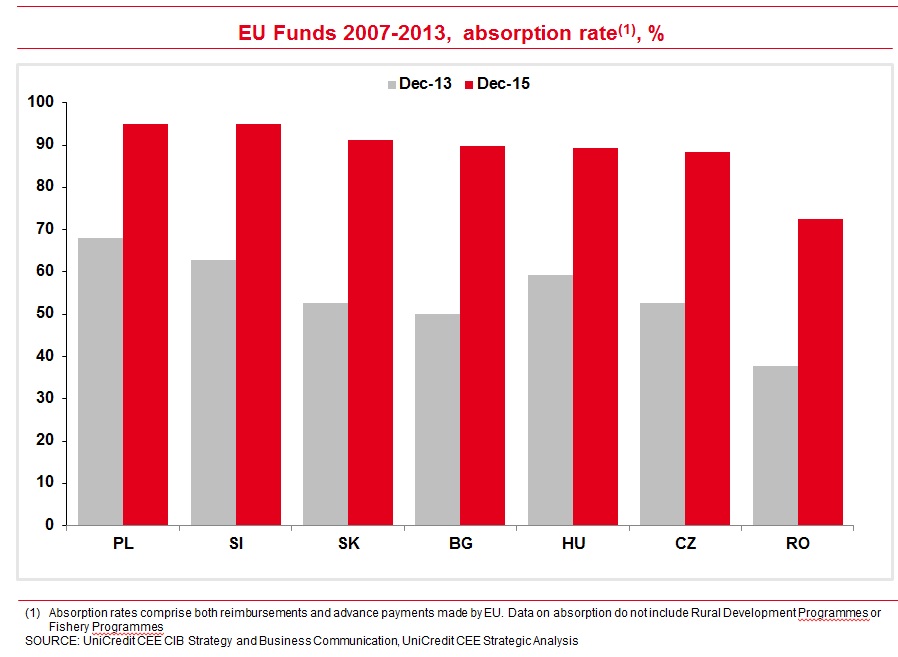

EU Funds are an important source of financing CEE-EU [3] economies, with banks providing advisory services, co-financing and financial intermediation. For the current programming period 2014 - 2020, more than EUR 200 billion has been allocated by the European Commission under the European Structural and Investment Funds for the CEE member states. Approximately EUR 117 billion is allocated to six CEE countries, being Bulgaria, the Czech Republic, Croatia, Hungary, Romania and Slovakia. Out of this, 20 per cent or EUR 23 billion, are meant to finance the private sector, where banks are mostly involved. "Around EUR 3.5 billion will be implemented through facilities approved by UniCredit", estimated Carlo Vivaldi, Head of CEE Division at UniCredit.

UniCredit re-invests EUR 13 billion in organic growth of CEE business

UniCredit considers itself a long-term, strategic investor in Central and Eastern Europe, which is keen to develop its business with both corporate and private customers in the region. Since 2007 CEE Division re-invested a total of EUR 13 billion in profit before tax in the region.

In 2015 the banking group has acquired over 1.2 million new customers across all CEE countries, where it has a presence, and it intends to grow its customer base by another 1 million customers each year until 2018. Over the same period CEE CIB aims at increasing its number of customers by approximately 10,000 corporations annually. According to its Strategic Plan UniCredit is going to invest EUR 1.2 billion into digitalization aiming equally at matching new trends in customer behaviour and reducing costs. The number of internet banking users is projected to increase from currently 5 million to 10 million and the number of mobile banking users from currently 1 million to 7 million over the next three years. CEE lending volume is expected to grow by EUR 20 billion to EUR 106 billion in 2018.

"We are fully committed to the new Strategic Plan and its implementation is fully on track, including the intended transfer of CEE shareholdings from Vienna to Milan by year-end 2016. With this step, we lay the foundation for an even leaner governance structure and a more effective capital and liquidity management within the Group", emphasized Carlo Vivaldi.

UniCredit is the banking group number one in Central and Eastern Europe - in terms of network, total assets and geographic diversification. The banking group operates an extensive network of roughly 3,000 branches in 13 countries, which generates roughly one quarter of its total revenues. UniCredit in CEE serves more than 26,000 international corporate customers. 2 out of 3 international corporate customers from Germany, Italy and Austria operating in CEE are served by UniCredit´s International Centers. The banking group has a long-established expertise in handling state and EU-supported programs in the CEE region resulting in more than EUR 2 billion facilities dedicated to EU Funds projects approved and another over EUR 1.3 billion agreements signed with the European Investment Fund in the first programming period 2007 - 2013. By this, UniCredit supported more than 8,000 CEE companies, mainly SMEs with EU funds and financial instruments.

London, May 11, 2016

Enquiries

UniCredit Media Relations International

Tiemon Kiesenhofer, Tel.: +43 (0) 50505 56036

Email: tiemon.kiesenhofer@unicreditgroup.at