UniCredit Unlocked garantirà una performance sostenibile e una crescita profittevole over the cycle consentendoci di ottenere un RoTE di almeno il 10% nel 2024.

Lo faremo agendo su tre leve interconnesse: costi, capitale e ricavi netti. Gestirle sinergicamente significherà bilanciare in maniera ottimale crescita, solidità e profittabilità.

Le efficienze di costo produrranno 1,5 miliardi di euro di risparmi lordi, 400 milioni dei quali solo da digital & data.

Allocheremo il capitale in maniera più efficiente, differenziando tra aree a maggiore e minore ritorno, privilegiando ricavi ottenuti con basso assorbimento di capitale in modo da massimizzare il ritorno sul capitale tangibile.

Continueremo a impegnarci per incrementare i ricavi in maniera coerente con il nostro risk framework.

Crediamo che il 2024 sarà solo l’inizio. UniCredit Unlocked getterà le basi per un successo di lunga durata, il nostro vero obiettivo.

Slide 1

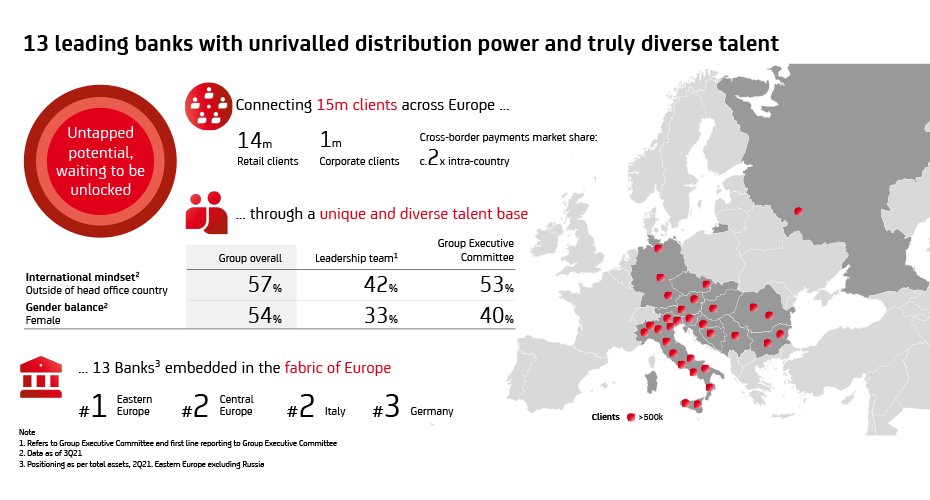

13 leading banks with unrivalled distribution power and truly diverse talent

Untapped potential, waiting to be unlocked

Connecting 15m clients across Europe 14m; 1m Corporate clients; c.2x Cross-border payments market share: intra-country

...through a unique and diverse talent base

International mindset2Outside of head office country - Group overall 57%; Leadership team 42%; Group Executive Committee 53%

Gender balance Female: Group overall 54%; Leadership team 33%; Group Executive Committee 40%

... 13 Banks3 embedded in the fabric of Europe

1 Eastern Europe #2 Central Europe #2 Italy #3 Germany Clients >500k

Slide 2

Our strategic imperatives and financial goals

Grow in our regions and develop our client franchise

Change our business model and how our people operate

Deliver economies of scale from our footprint of banks

Transform our technology leveraging Digital & Data

Embed sustainability in all that we do

RoTE of c.10% by 2024 and sustainable distribution of at least 16bn between 2021-24 via three interconnecting levers 0.5bnCost reduction, net of 0.6bn investment and 0.5bn inflation 150bps Organic capital generation, per annum 1.1bn Incremental net revenue, mostly driven by fees

Slide 3

Investing in digital, data and our people

Digital & Data 2.8bn Total IT investments1 2022-2

User experience New platform for unique and consistent experience across devices

New digital offering Digital onboarding, lending, advice

Payment value chain Simpler, faster, real-time payment management

Cyber security

Several initiatives aimed at continuously strengthening our cyber security defences

New hires 3.6k New hires 2022-24 +1.5k Business o/w +2.1k Digital & Data

Case studies

Smart banking

Germany

Advice and services available in a branch, online, via app or via voicebot

Smart invest

Croatia

Launch of simple advisory tool for effective and sustainable sales of investment product

AI-powered recruiting

Czech Republic and Slovakia

Smart recruitment chatbot which interviews, analyses and sorts candidates for first round according to suitability

High speed consumer loans

Austria

Pre-approved loans granted in under 5 minutes both within the branch and remotely

Slide 4

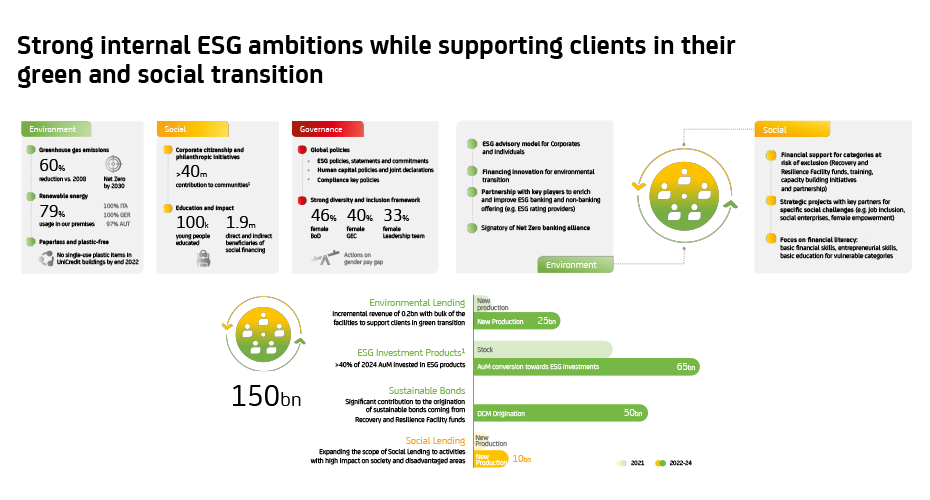

Strong internal ESG ambition while supporting clients in their green and social transition

Environment Our greenhouse gas emissions 60% reduction vs. 2008 Net Zero

Renewable energy 79% usage in our premises

Paperless and plastic-free

No single-use plastic items in UniCredit buildings by end 2022

Social 40m contribution to communities

Education and impact 100k young people educated 1.9m direct and indirect beneficiaries of social financing

l Governance Global policies ESG policies, statements and commitments

l Human capital policies and joint declarations

l Compliance key policies

Strong diversity and inclusion framework

46% female BoD

40% female GEC

33% female Leadership team

Environment

ESG advisory model for Corporates and Individuals

Financing innovation for environmental transition

Partnership with key players to enrich and improve ESG banking and non-banking offering (e.g. ESG rating providers)

Signatory of Net Zero banking alliance

Social

Financial support for categories at risk of exclusion (Recovery and Resilience Facility funds, training, capacity building initiatives and partnership)

Strategic projects with key partners for specific social challenges (e.g. job inclusion, social enterprises, female empowerment

Focus on financial literacy:

basic financial skills, entrepreneurial skills, basic education for vulnerable categories

150bn Environmental Lending

Incremental revenue of 0.2bn with bulk of the facilities to support clients in green transition New Production 25bn

ESG Investment Products

>40% of 2024 AuM invested in ESG products AuM conversion towards ESG investments 65bn

Sustainable Bonds

Significant contribution to the origination of sustainable bonds coming from Recovery and Resilience Facility funds DCM Origination 50bn

Social Lending

Expanding the scope of Social Lending to activities with high impact on society and disadvantaged areas New Production 10bn

Slide 5

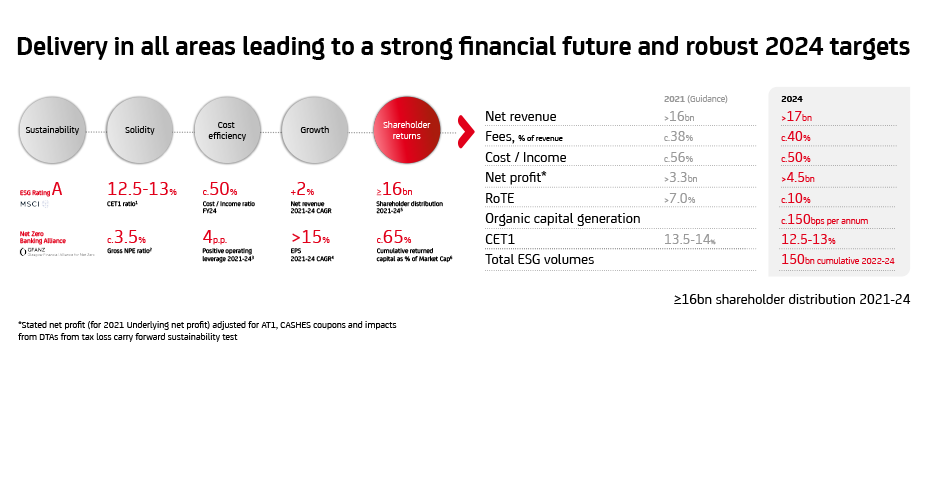

Delivery in all areas leading to a strong financial future and robust 2024 targets

Sustainability ESG Rating A; Net Zero Banking Alliance

Solidity 12.5-13%; CET1 ratio1 c.3.5% Gross NPE ratio2

Cost efficiency c.50% Cost / Income ratio FY24 ; 4p.p. Positive operating Growth

Growth +2% ; Net revenue 2021-24 CAGR ; >15% EPS 2021-24 CAGR4

Shareholder returns ≥16bn Shareholder distribution 2021-245 ; c.65% Cumulative returned capital as % of Market Cap6

Net revenue 2021 >16bn; 2024 >17bn

Fees, % of revenue 2021 c.38% ; 2024 c.40%

Cost / Income 2021 c.56%; 2024 c.50%

Net profit 2021 >3.3bn; 2024 >4.5bn

RoTE 2021 >7.0% Organic capital generation; 2024 c.10%

CET1 2021 13.5-14%; 12.5-13%

Total ESG volumes ; 150bn cumulative 2022-24

≥16bn shareholder distribution 2021-24

Slide 6

What defines us and how we do business

Win

For our clients: delivery of best-in-class products and services

For our investors: creating long term shareholder value

For us: uniting behind a single ambition and shared principles

The Right Way

Integrity

Ownership

Care

Together

As one team and with a common purpose

As true partners to all our stakeholders